The tangible book value (TBV) of S&P500 companies grew by almost 600% from 1975 to 2018. In the same period, intangible assets snowballed by more than 17,000%. It is essential to understand the two different asset groups. In this guide, you learn about tangible book value with real-life examples.

What is tangible book value (TBV)?

The tangible book value (TBV) is the company’s net value after liquidation. The remaining equity belongs to the company’s shareholders after it has paid off all its outstanding liabilities. The TBV is the total assets minus the liabilities and the intangible assets. It results in the company’s tangible assets, typically cash & equivalents, inventory, and plant, property & equipment (PP&E).

However, the tangible assets sold in a liquidation auction rarely raise the value carried in the books. Inventory usually sells for 50% to 80% of the value on the balance sheet. Equipment, or capital goods, is another item that sells lower at auctions. Only cash maintains its value.

Property, land, and buildings are assets that add cost to the balance sheet. After that, it is often not revalued, meaning the value can be significantly higher. The company would not get fair value for the properties in the liquidation process but can raise more than initially thought.

Intangible assets are non-physical assets such as copyrights, trademarks, patents, goodwill, and more. These items don’t sell quickly. During liquidation, Disney can easily sell its brand, logo, trademarks, and more. Still, the local shoe store will likely not find a buyer for its logo.

Tangible book value per share (TBVPS)

Comparing the value of tangible assets between businesses is not possible, even in the same industry. Every company has different assets in the books. Divide the tangible book value by its outstanding shares to make the TBV comparable between businesses. The relative valuation is the tangible book value per share (TBVPS).

TBVPS = \frac{TBV}{S_{outstanding}}

Where:

S_{outstanding} = the outstanding shares of the company

Price to tangible book value (PTBV)

The price to tangible book value is another ratio to compare the TBV between businesses. Nowadays, most assets are intangible. Thus comparing tangible book value is most useful for comparing capital-intensive industries. The formula is the price divided by the tangible book value per share:

PTBV = \frac{P_{share}}{TBVPS}

Where:

P_{share} = Share price of the company

What is the difference between book value and tangible book value?

The book value is equal to the equity of the company’s shareholders. Subtract the liabilities from the assets on the balance sheet, resulting in the book value. The assets include tangible and intangible assets.

The company may inflate the intangible assets to make the balance sheet appear more robust and healthier. Estimating the percentage of intangible assets with respect to the total balance sheet is good practice. Intangible assets have grown rapidly during the last decade, where the ICT sector is the most intangible-asset rich.

The book value differs in how goodwill and other intangible assets are subtracted to arrive at the tangible book value. Management values the company going concern, which means it will continue operating in the foreseeable future. When the company is heading towards bankruptcy, tangible assets have the most or only value.

Why use tangible book value for business analysis?

Value investors search for businesses below their fair value. They consider several factors to determine the company’s fair value. One of them is the value of assets on the balance sheet. The equity for the company’s common shareholders comes from assets minus liabilities. Thus the higher the assets, the more equity for the shareholders.

It isn’t possible to sell goodwill during liquidation. The intangible assets have a subjective value, and there are no viable methods for assigning a fair market value. It’s one of the reasons why value investors instead look at the tangibles only.

Another reason is the chance of hidden value in tangible assets. Most assets are carried at cost instead of the fair market value. Finding a hidden gem between the assets before others can give you a significant advantage. Peter Lynch calls this asset plays and goes into depth in his book “On Up on Wall Street.”.

Assets such as land, real estate, railroads, TV properties, drug patents, and more are among these assets. The disadvantage is that it can take a while before other investors recognize the value. It can take years before the value of the company grows. Timing is more critical in asset plays.

How to calculate the tangible book value?

In most cases, stock screeners calculate the TBV for you. When you find hidden gems or want to include the fair market value of real estate, you have to calculate the tangible book value. Looking at the TBV, its formula is the total assets minus the liabilities, further reduced by the intangible assets. Goodwill is also intangible but is often stated separately on the balance sheet.

TBV = A\> –\> L\> –\> A_{intangibles}\> –\> G

Where:

A = assets on the balance sheet

L = liabilities on the balance sheet

A_{intangibles} = intangible assets

G = goodwill

Goodwill is what a company pays for acquiring another company above fair market value. Goodwill is checked yearly for impairment because, like lay-offs, the company’s value may decrease under certain circumstances.

Retail store example

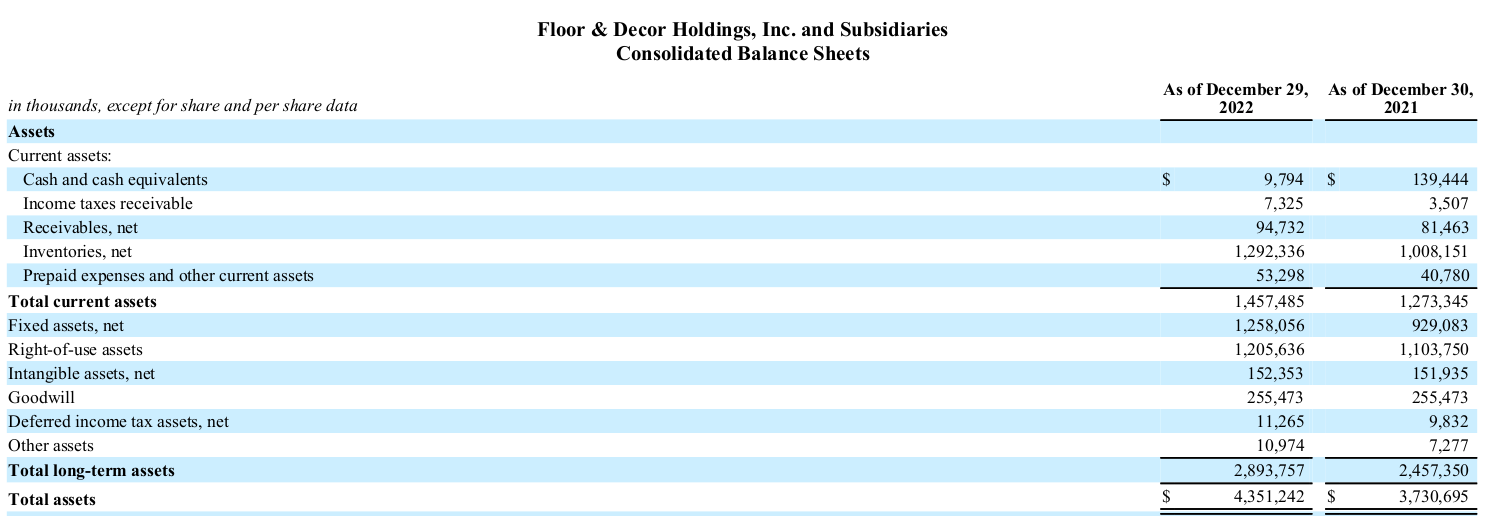

Let’s look at the tangible book value of Floor & Decor Holdings (FND). The figure below displays the assets of the balance sheet for 2021 and 2022. The assets are divided into two segments: current assets and long-term assets.

The GAAP accounting method requires the company to indicate the assets from most liquid to illiquid. The IFRS requires the list of assets to start with the illiquid assets and end with the most liquid asset, cash, and cash equivalents.

FND follows the GAAP method. Let’s look at the assets to understand the tangibles and intangibles of the business. The top of the list is the cash and cash equivalents. Cash is always accessible and marketable securities can be 90-day treasury bonds. Income taxes receivable are what the government owes the company. Since the government can always pay, it is a liquid asset. These three items don’t need further explanation on the liquidity of the assets.

The item ‘Receivables‘ is money owed by the company’s customers and carries a degree of risk. Usually, the company receives every payment. Some customers can’t make the payment of bankruptcy declaration others try to avoid payments. Customers like this are a tiny percentage of the total number of customers. Hence, it is a small degree of risk on the balance sheet.

In inventories, most of the stock sells with a couple of exceptions. Inventory stays on the shelves because of old tech, food expiration dates, and last year’s fashion clothes. FND sells floors, tiles, etc., which has less chance of inventory write-offs. Return of items and broken products are causes of write-offs.

The last current asset is prepaid expenses. These expenses are paid in advance but have yet to be incurred. Examples are insurance, office equipment, etc. It speaks for itself that prepaid expenses have risks. The paid companies for the goods and services can go bankrupt or decide not to deliver.

Next are the long-term assets. FND has land, buildings, furniture, computers, and software under fixed assets. The balance sheet carries these items often at cost. Furniture, computers, and software lose value quickly. Property, on the other hand, may grow in value over decades. Value investors estimate the fair market value to understand the company’s worth better.

Right-of-use assets are the right to use assets over their rental lifetime.

A company defines in its financial statements what qualifies for intangible assets. Floor & Decor Holdings places customer relations, non-compete agreements, and trade names under intangibles. Goodwill is part of the intangibles but has its item on the balance sheet. The acquisitions made in the past were paid above fair market value.

Deferred income tax assets reduce future taxable income. This item increases the net income but can’t be exchanged for cash. Hence, this item is illiquid. The company does not define the other assets.

Now we know all the items on the asset side. In this case, it is optional to understand every item as they are categorized. The balance sheet for the financial year 2022 shows that total assets are $4,351,242 and liabilities are $2,694,066. The goodwill is $255,473, and the intangible assets are $ 152,353. After subtracting everything from the assets, the resulting tangible book value is $1,249,350. Note that the figures are in thousands of dollars.

The TBV for 2021 is $915,791, where total assets are $3,730,695; liabilities are $2,407,496; intangible assets are $151,935; and goodwill is $ 255,473.

What is an acceptable tangible book value?

In general, the higher the tangible book value, the better. Also, a yearly growing TBV is preferred. But make sure to look at this figure. You need to understand and investigate why the TBV went up.

As we saw with FND, the inventory and fixed assets increased. An increasing inventory can be a bad sign for a company. They are converting cash into products nobody wants to buy.

In the case of FND, this is not the case. They opened 31 new warehouse-format stores, according to the annual report. Knowing the story of a company helps you understand the numbers on the statements. When you need more clarification, take a look at the same-store sales. Does it increase or decrease? The notes from the management also go over the figures and tell you what you want to know.

Bottom line

In summary, the tangible book value (TBV) is the liquid assets on the balance sheet. You find the TBV by subtracting liabilities, goodwill, and intangible assets from the total assets. Tangibles are usually carried at cost and may grow when other investors notice the hidden value. Investments like this are named asset plays, according to Peter Lynch.

When a company is close to bankruptcy, the tangibles are more valuable than the intangibles. Tangibles are cash, inventory, property, etc., and are more likely to generate cash at the auction. In contrast, intangibles are trademarks, patents, and copyrights.