We cover the 4 most used investment strategies with each their own goals, risk tolerance, and uniqueness. Choosing a suitable strategy that fits your needs is the first step to investing. Many strategies, algorithms, and variations of the two are in use in the financial world. These are complex and require a lot of knowledge. Luckily for you, the investment strategies for retail investors are limited and not complex. Here we discuss different investment strategies ranging from beginners level to a more advanced level.

1. Passive Investing

Passive investing is buying exchange-traded funds (ETF) or mutual funds and is considered one of the beginner investment strategies. It is typical for investors to use dollar-cost-averaging, buying on a set time interval, to buy these funds. And hold on to them for a long time.

An ETF is a low-fee investment security that tracks a sector, commodity, index, or other assets. A well-known ETF is the SPY which is one of the first ETFs of America. It contains the 500 companies in the S&P 500 to track the index. You can trade an ETF like it is a stock, which makes it also easily accessible for the novice investor.

The strategy for passive investing is buying into a mutual fund or ETF on a consistent interval. For example, you invest every month 10% of your salary. The time interval and capital you are willing to invest are for you to choose.

The key to passive investing is consistency. Invest always on your specified time interval regardless of the ETF’s price. This results in investing at the average market price over a long time. As your purchases average out the highs and lows, you do not have to worry about timing the market. The main effort with this strategy is choosing the right fund and do not switch funds. Unless you have very good reasons that something is wrong with the fund of your choice.

Passive investing is for the investor without much time on their hands nor is willing to put time into market research. Choosing the fund is a one-time effort. From then on, it is frequently buying into the same fund over and over. With some brokers, it is even possible to set up an automatic buying process.

The advantages of passive investing:

Low costs: funds have typically a lower expense ratio compared to actively managed funds. The lower costs can have a significant impact on the investor on the long-term returns. The costs are low because the fund manager does not need analysts to find well-performing companies.

Broad market exposure: diversification of the fund helps to reduce risk against different sectors or industries.

Simplicity: an ETF trades like a stock and is an easy way to invest in a market or sector because it tracks an index.

The drawbacks of passive investing are:

Limited outperformance: passive investing is mostly based on replicating the performance of the market or index. Your returns will be as good or bad as the market performs. Unfortunately, you can not take advantage of mispriced assets and outperform the index.

Downside risk: since it replicates the market, there is no protection against a downward-moving market. The value of your portfolio goes down with the market. On the bright side, you can buy more into the fund for a lower price as the market is on a discount.

Poor performers: the market consists of well- and underperforming companies. Passive investing follows the total market. You automatically have poor-performing companies in your portfolio. These reduce the annual returns and there is no way to avoid them.

Concentration risk: some sectors or companies may be a bigger share of the total ETF. This means that some sectors going up or down have a bigger impact on the valuation. An index is not evenly distributed. Every company has a different weight to make up the total index.

2. Growth Investing

Growth investing is a strategy that is focused on companies with an above-average growth rate and a positive cash flow. Typically those companies are small and or in an emerging market. The companies can be market disruptors or active in rapidly expanding sectors/markets. AI, for example, is now a popular sector to invest in.

A company does not have to operate necessarily in a fast-growing sector. They can also capture a bigger market share in a slow-growth sector. An example is Monster Beverage Corporation (MNST).

Note

Growth stocks can be found in high-growth and low-growth industries. Many people prefer the action in high-growth industries like technology. There is the competition high with competitors and market analysts. There is no competition in a low-growth business. It is easier to gain a big market share. Industries like this are funerals, bottle caps or motel-chains.

Usually, companies suitable for growth investing have greater revenue and higher earnings compared to their competitors. These two things make growth stocks in general appreciate in value. Also, the speculation of future earnings and growth are aspects to valuate a growth stock currently higher.

Finding growth stocks is not easy for investors. It involves fundamental analysis, which is reading and interpreting the company’s financial documents, identifying market trends, and understanding the competitive advantage.

Growth investing carries a bigger risk compared to passive investing. But if it is done right, you can reap the rewards. Pros of this strategy are:

Wealth accumulation: the potential for high returns makes it possible to accumulate wealth over a longer period. Compounding profits allows you to let your investment capital grow fast.

Flexibility: choose your stocks with a high growth potential. The flexibility allows you to diversify into multiple companies to spread the chance of finding a real winner with exceptional returns.

High returns: fast-growing companies may increase more in value compared to indexes. This strategy makes it possible for you to outperform the market. Growth stocks are considered to be the big winners of the stock market.

With big upside potential always comes higher downward risks:

Volatility: market sentiment, earnings reports, and changing industry trends may cause amplified price fluctuations. During market downturns, the price of growth stocks may experience larger losses than other stocks from the same sector.

Future performance: this strategy is based on future expectations, which are factored into the current price. This leads in general to higher valuations. Companies are not always able to live up to those expectations. Prices may drop and the investor is likely to suffer losses. Predicting the future growth of companies is difficult, which leads to many mispriced stocks.

Dividend: the dividend is often 0% as many growing businesses choose to reinvest the profits in growing further. This is actually beneficial for the investor in the long term. It may result in growing faster and bigger. And the investor gets either more for his/her investment or gets it back quicker.

An investor needs a high tolerance for market fluctuations and risk to deploy this strategy. Besides the investor has to do lots of research to find the most promising ones and most likely to succeed.

3. Value Investing

Value investing is finding undervalued companies based on intrinsic value. Stocks can be out of favor with the general public, which may result in undervaluation. It is believed that value investing is contrarian as you go against the popular opinion of the market.

The intrinsic value is a measure of what an asset is worth, in this case, stocks. So you are looking for companies who trade a lower share price than the company is worth. Determining the worth considers many metrics.

Potential future profits and cash flow are mostly looked for to find the intrinsic value of a company. Profits can be distributed in various ways to the shareholders through dividends, stock buy-backs, and reinvesting in the company (retaining earnings).

You need to understand the nature of the business and the market it operates in, to successfully use this strategy. This is because you need to make an educated guess of the future profits. Stable companies with strong balance sheets and a steady cash flow are easier to predict. That is why most value investors look for steady businesses, like Coca-Cola (KO), but are not limited to.

>> Learn more: how the financial statements are linked

Besides metrics from the financial statements, other factors are also looked for. For example, management has a big part to play in the direction of the company. It is preferred to have stable management that worked for years and will work for many years to come. They put the company first instead of themselves. In many situations, management is the other way around.

"Behind every stock is a company. Find out what it's doing."

Peter Lynch

Finding the right company to invest in takes time. When you find the right company, most of the work is done and you only have to check in regularly to see if the company is still operating well.

The advantages of value investing are:

Undervalued opportunities: as mentioned earlier, you aim for stocks trading below intrinsic value. Investors can benefit from the price appreciation and actual profits of the business. When you hold stocks for 20+ years, the undervalued aspect has not as much impact as when you hold only for 5 years.

The margin of safety: stocks trading below their intrinsic value have a so-called margin of safety. The gap provides a cushion when the market makes significant downward moves. Undervalued stocks tend to move slower downward.

The intrinsic value estimation may be a little less than expected. The margin of safety leaves room for error by the investor.

Dividend: value stocks have often dividends as they are established businesses. Long track records of stable cash flow make dividends a viable solution to return cash to shareholders. It can create an income or can be used to invest in new businesses.

The risks of value investing are:

Value traps: not all companies with a low share price to earnings (P/E ratio) are good value stocks. Stocks can be cheap for many reasons, including lawsuits, management issues, and declining industries. All these have a negative influence on the long-term prospects of a company.

Underperformance: value stocks can underperform for an extended time. The market may not be able to recognize the true value of a business for a long time or not at all.

Limited growth: often value stocks are matured companies with a slower growth rate than growth stocks. It offers stability and dividends, but rapid capital appreciation may be limited.

Value investors do have a long time horizon and are not realizing quick profits. You hear others with great success and you have to fight the emotions of changing investing strategies. The tolerance for risk of the value investor is often lower as they look for established businesses with an economic moat.

4. Income Investing

Income investing has the purpose of creating an income to live off. This strategy can be used in various asset classes like bonds, stocks, and real estate. It is a popular strategy among retirees to have an extra source of income.

At first, income investing seems rather easy. But nothing could be further from the truth. Money has less buying power year over year, because of inflation. It also happens with income investing. You want to preserve capital and have extra income.

It is easy to find a stock with a high dividend, but the stock does not appreciate in value. You can buy extra stock from the dividends and rake in more during the next payout. But this reduces the income from dividends significantly. An example of such dividend stock is telecom provider Vodafone Group (VOD). The provider declines for years even with a dividend of 10%.

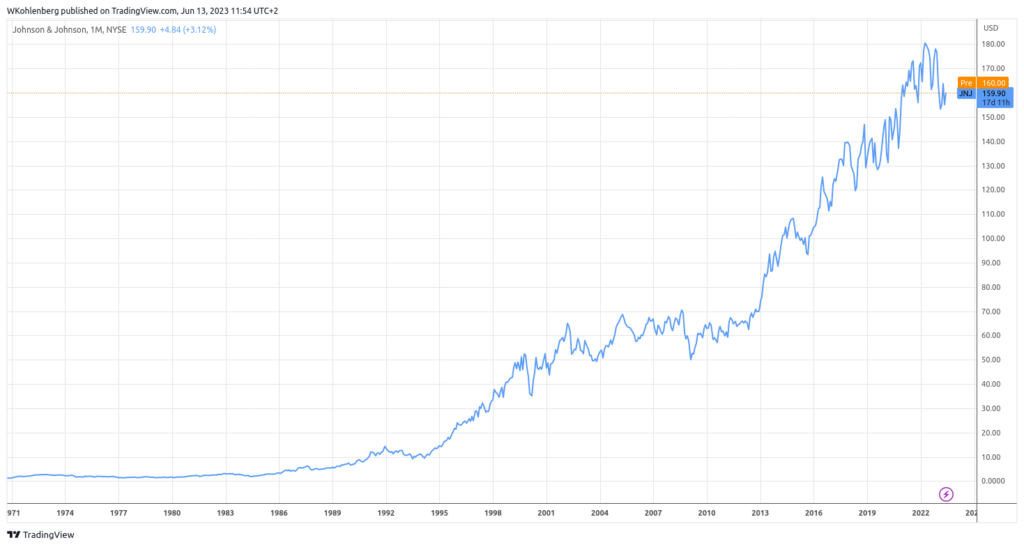

It is possible to find appreciating stocks with decent dividend payouts, although the dividends are somewhat lower. An example is the pharmaceutical company, Johnson & Johnson. A nice addition to this company’s dividend payout is the dividend growth. JnJ has yearly growing dividends for 62 years in a row, which is also an attractive feature for value investing.

The advantages of income investing are:

Income stream: the possibility to live off the quarterly or yearly income from dividends, interest rates, or rent. This is welcoming to investors who rely on regular income or prefer a more consistent cash flow to meet their financial needs.

Capital preservation: many income-focused investments prioritize the return of principal, the deposit, along with interest payments. The type of investments are bonds, Real Estate Investment Trusts (REIT), and fixed-income securities. These investments are in general less volatile.

Dividend growth: a yearly dividend payout growth by the company is a common aspect. Dividend growth stocks give the unique opportunity to have a regular income and capital appreciation to keep up with inflation.

And the risks are:

Capital deprecation: stocks can appreciate over time, whereas income-focused investments deprecate. This is not good for the investor’s buying power, which can result in lower returns over the long term.

Interest rates: fixed-income securities, like bonds, are sensitive to the change in interest rates. The bond price typically declines when interest rates rise and visa-versa.

Inflation: inflation can eat up a significant portion of the buying power over time. The interest rate on bonds or dividends for stocks can not compensate for it in the long run, when inflation increases. Central banks try to keep inflation at 2%. But since 2022, inflation increased more than 10% in a single year.

Investors with a small tolerance for risk make use of this strategy. People close to retirement or retirees often have more exposure to dividend stocks to reduce volatility in their portfolios.