In this guide, you will be learning how to invest in stocks. It covers everything a future investor needs to know. A retail investor has written it for you investors. Over time this article will be updated and expanded to your benefit.

In this guide, you learn:

Why investing is essential and why to choose stocks over other asset classes.

Is investing for you?

What are the first steps to investing?

Choose the right broker.

How much money should you invest?

What tools and equipment do you need?

When to buy and when to sell?

Protect yourself against risk.

The need for a financial adviser, yes or no?

As you will read along, extra information is given to dive further into the subject.

Why is investing important?

You can go through life without personally investing your money. But most investing is done for you without you knowing. And for your benefit. For example, private insurances invest their capital to pay off future claims. Retirement saving plans like the 401(k) for Americans and pension funds in Europe allocate capital to several asset classes for the long-term to pay out your retirement in the future.

In these examples, you can see that you put money aside for later. The value of money decreases over time because of inflation. Wise investments protect you against inflation.

Several other reasons for investing your own money are:

Financial goals: funding your children’s education or buying a house.

Wealth growth: beat inflation and grow your capital in the long run.

Passive income: investing in dividend-paying stocks or rental properties can provide regular cash flow without requiring active work.

Retirement: create a nest egg to have a more comfortable retirement.

Your capital in investments works for you without you being required to attend in person.

Is it better to save or to invest?

Saving and investing both have their own benefits. It depends on factors such as financial goals, time horizon, risk tolerance and your current financial situation. A balanced approach between the two is often beneficial.

If you have short-term financial goals or anticipate the need for funds in the near future, saving is typically the safer option. For example, creating an emergency fund, a down payment on a house or a car. Financial goals within the next two years are more suitable for saving as you can access the funds quickly.

Investing is generally more suitable for long-term goals because it allows for potential growth over an extended period. Markets involve fluctuations and risk. This is more likely to be reduced over the long-term. When your time horizon is long, you can afford short-term fluctuations.

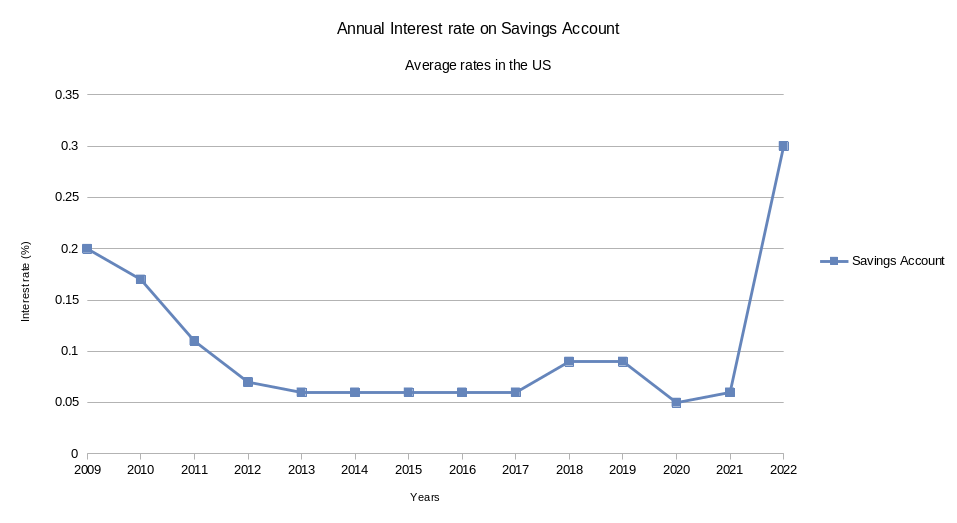

In figure above is shown the annual interest rate on savings accounts in America for the period 2009 till 2022. The interest rates became low after the stock market crash in 2008 and never fully recovered. A savings account of $10,000 in 2009 would have a balance at the end of 2022 of $10,145. While an investment of $10,000 in an S&P 500 index ETF, would get you approximately $42,500 over the same time period.

Why invest in stocks?

There are various asset classes to invest in, like bonds, real estate and commodities. But stocks are preferred over the long term. As it gives you benefits over the other classes. It is not uncommon to include bonds or even real estate in your portfolio. It comes down to your risk tolerance, time horizon and what asset classes you are comfortable with.

The main reasons to invest in stocks are:

Potential for high returns: while stock prices can be volatile in the short term, over extended periods, they have the potential to deliver substantial growth.

Ownership in a company: buying shares makes you partial owner (shareholder) of the company. This ownership entitles you to a share of the company’s profit through dividends or potential capital appreciation.

Capital appreciation: a stock can grow substantially based on the performance of the company. But do not confuse the value with the price increase because of popularity.

Dividend income: some companies decide to distribute a portion of their profits to shareholders. This can generate an income stream which is attractive for retirees.

Liquidity: stocks are bought and sold easily on the stock exchange. This allows you to exchange your investment relatively quickly for cash if needed.

Is investing for me?

Investing is for everyone and everyone should be able to get positive returns. But how does it come that not everyone gets positive returns? Qualities like patience, self-reliance, persistence, tolerance for pain and common sense are helpful to becoming a successful investor. You will learn these qualities over time.

Determining whether investing is for you depends on your financial situation, risk tolerance, time horizon and personal circumstances.

To get your finances in order, make sure to pay off your debt first before even thinking of investing. Americans have, on average, a little over $12,000 in debt excluding mortgages. And set up an emergency fund for 3 to 6 months, if you do not have one already. After this, you can use a portion of your savings as investment capital.

This is capital you do not need in the short-term. To have your financial situation under control makes you act more calm on the stock exchange and have a more patient approach.

As discussed before, your time horizon is an important factor for deciding between asset classes. You will see great results in stock investments over a period of 10 to 20 years.

Your risk tolerance is all about having the stomach for investing. The stock markets have daily fluctuations and are often found to behave irrational. Do not let this scare you off, as there are ways to defend yourself against the volatility. And you will sleep better at night.

How to invest in stocks?

First, pay off your debt and create an emergency fund. This is step zero. When you are at this step, it is a great time to educate yourself on investing in the stock market. Read relevant articles for you on this website. Or read books like: ‘The Intelligent Investor’ and books by Peter Lynch.

Define your financial goals

Decide for yourself what your financial goal is and write it down. Defining your goals will guide your investment decisions and help you to stay focused. You can have multiple financial goals, but try to limit them to one or two. This makes deciding on investments easier for you.

Beginners in the field of investing often make the mistake of having the following financial goal: I want to make 1% profit per day. This is not the right approach to investing. There are days of ups and days of downs. The short-term fluctuates and the long-term shows the trend. So do not get distracted by daily movements.

A better goal is specific and measurable. For example: “I want to have an investment portfolio value of $500,000 with an average annual return rate of 8% over the next 35 years when I retire”.

This goal guides you in your investments, because now you will not invest in a company which has only a annual return rate of 5%. You are looking for companies with a return rate of 10% or more to compensate for the years of a down-turn.

Choose the right stock broker for you

Choosing the right stock broker involves considering several factors based on your needs and preferences. Take the following into account to find the right broker for you:

Determine your needs: what type of investments you want to make (stocks, ETFs, mutual funds, etc.)? Do you need access to international markets? Would you like to have customer support?

Products: as an investor, wanting to buy the stock, which makes you a shareholder of the company. Some brokers sell you only contracts for difference (CFDs). When you hold CFDs, you only place a bet on the change of the price in the future. You are definitely not owning a share in the company.

Account options: are the options in line with your financial goal(s).

Regulation: check the financial authorities to verify if your broker is properly regulated.

Platform and tools: review the platform and tools provided by the broker. Is it a user-friendly interface? Does it have real-time market data?

Fee structure: look for commission fees, account maintenance fees and minimum account balance. Does the fee structure align with your investment style?

Reviews: read reviews about the broker to gain insight into the pros and cons. Make sure to use independent review websites like trustpilot.

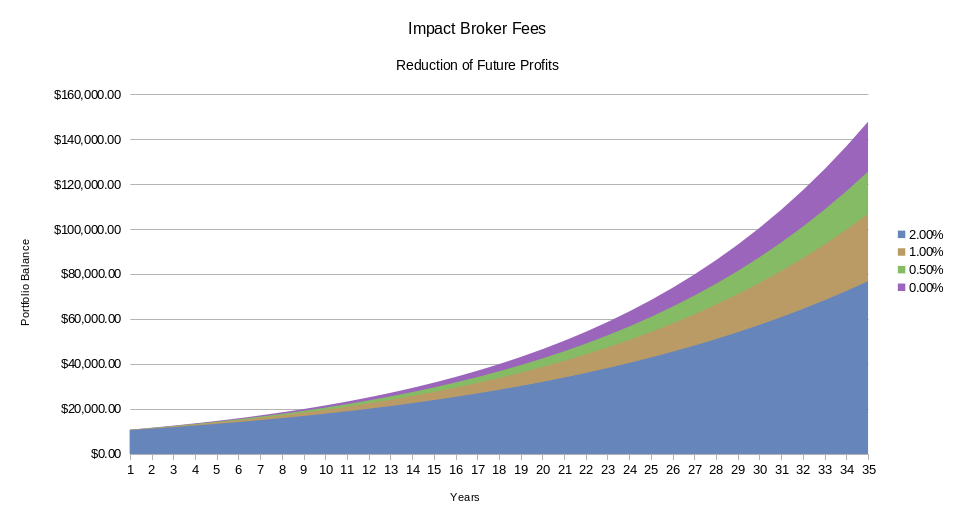

The fees charged by the broker reduce your future profits. It is important to find a broker with a low percentage fee structure. In the figure below, it shows the impact of maintenance fees for different percentages.

A starting capital of $10,000 and an annual return rate of 8% on stocks and zero maintenance fees (purple) over 35 years gives you ~$147,000. A 2% fee (blue) gives you as little as ~$76,000 after 35 years. This chart does not take other broker fees, such as for opening/closing a position, into account.

Choosing a stock broker is a personal decision. What works for one does not necessarily work for another investor. So do your own research and find the one that suits your needs. Try to open a demo account or start small to get used to the experience of the broker’s platform and services before committing large sums of money to the broker.

How much money should you invest in stocks?

There is not a minimum or maximum for capital you have to put into the stock market. This depends on your financial goals and what you are comfortable with. Often, investors find themselves putting in starting capital and putting a part of their monthly salary in their broker account. You are not obliged to do this, it is your personal preference.

When you find yourself not able to sleep at night, because you worry about the direction of the stocks, then you have probably invested more than you are comfortable with. This can be used as a guideline for the maximum capital you should invest.

For the minimum there is no such rule. The more you can put in, the more you potentially can profit in the future. When you are new to the stock market, start small. This is to get used to the broker platform and getting comfortable with the process of investing.

How much should you invest in stocks the first time?

A broker often has a minimum capital requirement to open an account. This can vary from $100 to more than $1,000. Also, some brokers have a fee structure in place where you pay a fixed fee for opening smaller orders.

For example, up till an order worth $5,000, you pay $5 to execute the order. Above this threshold, an additional fee is applied. So every order you put in below the threshold is the same fee applied. An order worth $1,000 is more costly to execute compared to one of $4,500. The fee on $1,000 is 0.5% and on the order of $4,500 is 0.11%.

The fees can add up quickly and have a big impact over the long run. So, choose wisely or save up more capital before you begin.

What investment strategy should you follow?

When it comes to investment strategies, there is no right or wrong. You are allowed to modify a strategy to what you are comfortable with. There are different methods for investing that you can build on.

The Buy and Hold strategy involves buying high-quality investments with the intention of holding them for a long period of time. No matter in what direction the short-term stock moves, you hold the investments until you get signals that the company does not perform so well anymore.

Investing is buying and holding for an extended period of time. It is the basis for finding high-quality investments. Here we focus on the shares outstanding from public companies. These companies are obliged to file quarterly and yearly reports on the business.

These documents are the financial statements, named 10-Q and 10-K. You can research how the company performs at the Securities and Exchange Commission (SEC) for American companies.

Do extensive research to find a competitive advantage of a company in an industry you are familiar with, known as the circle of competence. Decide to invest in the company or move on to other stocks. The decision is made on criteria set up by you.

Examples of criteria could be a yearly increase in dividend, yearly +10% net profit growth, etc. There are plenty of criteria you can look at. Do you look for growth or do you want a steady passive income with growing dividends?

>> Learn more: 4 investment strategies for retail investors

What tools and equipment do I need?

An investor does not need many tools and equipment to become successful in finding wonderful businesses. This again depends on the personal preference of said investor. Educating yourself on the matter is a good start. Also, later on, it is wise to keep educating yourself.

For example, read books by known investors. Look at informative websites, such as this one or investopedia. Or read analysis from other investors, to learn new approaches.

A computer or a laptop is perfect for accessing the broker and reading the company filings. A laptop is preferred, as you are more flexible in terms of location. You can keep notes on it or write them down in a notebook.

Stock screener platforms, like TIKR and Stock Rover, provide information about public companies globally. You can find public companies suitable based on performance. Public information, such as financial statements and earning reports, is spread over multiple sources. Stock screener software brings public information together in one place. It saves time to have every piece of data available in one location.

| Must have | Nice to have |

| Laptop/computer | Stock screener software |

| Broker account | Comfortable chair |

| Educational material | Desk |

| Notebook | Monitor (second screen) |

| Printer |

>> Learn more: 5+ best stock screeners

How much time do I have to spend on investing?

Investing takes only a couple of hours a month. You only have to read the three financial statements every quarter. You are a car sales representative, for example, and the car industry is the industry you know in and out. Then keeping up to date with companies like Volkswagen, GM and Ford is a small effort.

Maybe you want to take up some second-hand car resellers, like Carvana, on your reading list. When looking for high-quality investments within an industry, limit yourself to a maximum of 5 to 10 companies.

The fewer companies you follow, the more time you have to know the ins and outs of a company. You may want to look at a second industry within your circle of competence later on. This costs, of course, much more time.

The amount of time spent differs from investor to investor. You only need a couple of hours as a minimum. Others want to spend a couple of hours a week. Experiment with what suits you and if your schedule allows it.

When to buy stocks?

There is not an easy answer to this. You define the criteria for whether you allow yourself to buy the stock of a company. Often, metrics like profit margin and debt are used to determine how healthy a company is. This means it is worth your time to research the company further.

To know how well a company is doing, investors compare the company with competitors in the same industry. This is to put metrics in perspective. What is an acceptable margin in one industry is low for another industry.

At some point, you will find a company that checks all your boxes. And now? Do you buy all the shares you can afford in one order? Or do you use dollar-cost-averaging? Are you waiting for a lower price?

A company has an intrinsic value and from here you can decide the value per share. Apply a margin of safety because of the estimates you make in determining the intrinsic value. When the actual share price is below intrinsic value, including the margin of safety, then you are able to buy a part of a company at a discount. And who can ignore a discount?

Dollar-cost-averaging is a method for opening or closing a position in multiple orders stretched out over a time period. The argument for using this method is to prevent people from buying too high. Others divide an order into smaller orders when the total number of shares impacts the price, if executed all at once.

Waiting for a lower price is usually not the way to go. Because, you can not know in the short-term if the price will go down and when it is at lowest share price. This makes you look at the share price like a hawk. And it has more to do with trading than investing.

To prevent yourself from stress and being glued to the screen, buy when the share price is on discount.

When to sell your stocks?

Just like buying a stock, selling the stock can be a complex decision. Every situation is unique with its own reasoning. It is based on several factors:

Change in company fundamentals: a significant decline in market share, discontinuation of dividend payout, or even changes in the law, may deteriorate the company’s long-term prospects.

Rebalancing portfolio: some investors like to have a portfolio of different assets and need to adjust the allocation to each asset in a regular timeframe.

Achieving your financial goal(s): you reached the target and need to lock in the profit to place the down payment for the house, for example.

Overvaluation: companies are undervalued and overvalued all the time. You can decide to sell a company whose price is overvalued compared to its underlying fundamentals.

Better investment opportunity: your research showed a new opportunity with a higher expected rate of return than the current investment. Changing to the new one gives you potentially higher future profits.

As you can see, there are several reasons to sell your investment. Access for every investment when you need to sell. Tell yourself why you need to close the position. This prevents you from locking in profits, just because you do not want to lose some profit.

How to protect against risk?

Risk management is a decades-old discussion within the financial industry. There is not one answer to this. Some professionals are better at managing risk than others. Take Warren Buffett for example. He has runs the conglomerate Berkshire Hathaway since the 70s. His keeps his investments for decades or buys the whole company.

"Risk comes from not knowing what you're doing."

Warren Buffett

His key take aways on risk are:

Long-term perspective: think like a business owner and have a patient, long-term perspective. This way, you can mitigate short-term market volatility.

Understand the business: his advice is to only invest in businesses you know very well.

Circle of competence: operate only in industries you know well. It is close to understanding business. But it can happen that you do not understand a business in an industry you know well.

Focus on quality: look for businesses with a strong competitive advantage and a sustainable business model.

Market fluctuations: volatility and fluctuations are opportunities rather than risk. During down-turns, you are able to acquire high-quality assets at attractive prices.

Margin of safety: buy assets at a significant discount to the intrinsic value. This provides a cushion to potential risks and uncertainties in the market.

Most of managing risk comes down to understanding a business. In the short-term, you could be wrong, but there is a high certainty that in the long-term it will be made up for it.

>> Learn more: 10+ Best Value Investors

Should you diversify or not?

Diversifying is another never-ending discussion. Wealth managers like Ray Dalio call diversification the holy grail of investing. While a great stock picker, Peter Lynch calls it diworsification. Who should you believe?

Diversifying does not guarantee profits. Nor does it protect you against potential losses. As an investor, you have to decide how good your investment is. And how many assets do you want to have in your portfolio? Some say you need 10, others say 20 or even 30.

Look it from this point of view. You find the best company to invest in you can find after searching for a year. You read up on countless companies. In the process, you found 4 other good companies with lots of potential. And you decide to invest in all four companies, with the best company getting a 50% allocation.

When others say that you need at least 10 companies in your portfolio, which five do you add? You only found 5 great ones. Usually your 10th idea is not better than your first idea.

What stock market should I invest in?

Most of you have heard of the American indexes S&P500, Nasdaq Composite and Dow Jones Industrial Average. Those indexes are equity indexes made up of companies traded on the stock exchanges in America. The lion’s share of trading in terms is done at the two stock exchanges, Nasdaq and NYSE.

Japan, Europe and China also have stock exchanges with respective indexes. Japan has the Nikkei 225. Europe has the STOXX 600. And every European country also has its own index. And China has indices such as the Shanghai Composite and Hang Seng.

With many markets all over the world and plenty of companies to choose from, it is not an easy task to select the right market. When you just start out, it is good advice to start within your country. You are familiar with most companies because of the news coverage. For brick-and-mortar stores, it is possible to pay a visit.

It is likely that you understand companies in your own country better compared to the ones in other countries. This is because of corporate culture, being a customer or not and legislation to name a few.

When you get more comfortable with company structures and financial statements, it is possible to look for opportunities outside of the country or continent.

Make use of a financial advisor or invest on your own?

A financial advisor gives you advice on a regular intervals and may manage your portfolio. They give you expertise and guidance. It will free up your time, the emotions to investing are nihil and you do not have to learn how to invest in stocks on your own. These are some benefits for choosing a financial advisor or even a robo-advisor. It is based on machine learning models.

But you would not be here if you had no interest in investing on your own. Choosing not to take an advisor will save you costs. The future profits will be reduced significantly when paying a fee to an advisor.

Investing in your own gives you control and flexibility. It is your capital and you care about it way more than an external party. You would also miss out on many learning opportunities. It is a rewarding experience.

It is possible to choose a hybrid approach. If you are not sure of your abilities yet, manage a portion by yourself and let an advisor take care of the other portion.

Trading vs investing

Trading and investing are 2 different approaches to participating in the stock market. Both approaches have making money in common. The difference between the two can be found in time horizon, goals, approach and time commitment.

Trading is orientated on daily, monthly or quarterly returns. They buy and sell assets more frequently to profit from the volatility of the asset. The assets they hold are for a shorter period and can be more diverse to protect themselves against risk. Traders often use active trading strategies, based on market indicators, chart patterns or news events. They actively do day trading, swing trading or use other short-term trading styles, which costs a lot of time.

Investors, on the other hand, take positions for at least one year, but usually 5+ years. They usually buy and sell stocks to profit from the competitive advantages the company has. Investors may conduct thorough research on companies by analyzing financial statements and taking industry trends into account. The research can take some time, but it pays off as you only have to check in on the company every 3 to 6 months. Which only takes an hour or two.

Trading | Investing | |

Time Horizon | 1 day up to 3 months | >1 year, usually 5+ years |

Goals | Take advantage of market inefficiencies | Take profit from competitive advantages a company has |

Approach | Active, based on market indicators, chart patterns or news events | Passive, often method of buy-and-hold after researching a company thoroughly |

Time commitment | Actively monitoring the market on a daily basis. | Review investments periodically, every three to six months |

Is investing considered gambling?

Uninitiated people on the stock market often state that putting money in stocks equals gambling. Although, there are definitely people who use the stock market as a gambling platform to get rich quickly. This is often done through investment vehicles such as options.

Investing is typically done with the goal of generating long-term returns and building wealth over time. Successful investments require knowledge, research, analysis to make informed decisions. Skills and information can improve the investment outcome, whereas gambling is primarily determined by chance.

The stock market in the short-term looks like it behaves by chance. But the long-term trends eliminate randomness. You find satisfaction in long-term returns. Opposed to gambling, where results are immediate.

Both investing and gambling involve a level of risk. In investing, you try to mitigate risk through research, portfolio management and, for some, even diversification. The outcome of gambling is uncertain, uncontrollable and relies heavily on luck. It is not possible to mitigate the risk (although maybe by not playing).

Bottom Line

In summary, investing may bring you financial prosperity when done properly. There is a lot to learn and to cover before even making your first investment. Make plans and state the reason why you want to invest. And find a stock broker which matches your needs.

Look for companies you know well. These are usually close to home and where you are a returning customer. There is no need to start your investment journey overseas.

When you do not feel certain or want to save time, you can look at a financial advisor or robo-adviser. It has both pros and cons. So do your research beforehand, before outsourcing your investments.

I wish you lots of joy and fun on this magical journey!