Do you find yourself consulting multiple sources during your research of companies? With TIKR terminal, there is no need to open endless tabs to piece all the information together. It is a platform with all the fundamental analysis for the value investor. This in-depth TIKR terminal review addresses every feature on the platform.

Highlights

TIKR is a platform with many features for fundamental analysis. Ordinary investors have access to all public financial information without consulting multiple sources. The platform offers a stock screener with an extensive filter, financial statements, public filings, call transcripts, valuations, analyst estimates, and more for +100.000 companies worldwide.

TIKR is ideal for dividend, growth, or value investors. It has a business owner mode to hide stock prices and to make unbiased investment decisions.

Price

($0 – $39.95/mo)

Simplicity

Features

Likes

- 10y of financial statements, public filings, etc.

- +100.000 global stocks

- Call transcripts

- Ownership

- Extensive stock screener filter

Dislikes

- No email alerts for price targets

- No notes for tickers

About TIKR

TIKR terminal is a platform with a lot of investment data available. Its goal is to empower individuals and allow them to make better investment decisions. Investors on Wall Street have all the investment tools and data on hand. TIKR wants to take this advantage away by making it easily accessible for retail investors for affordable paid plans. They even have a free plan available for access to critical features.

TIKR features

The terminal’s design focus on the fundamental analysis of businesses around the globe. Analyzing a company requires filings & financial statements. Insights into ownership and insider transactions are convenient for studying management. Some even prefer transcripts of earnings calls to understand the business better. The retail investor has to gather all this information from multiple sources.

TIKR managed to bring every piece of public information, including news, to one platform! This saves you time to research more companies. All these features are divided into three categories: market overview, ideas generation, and fundamental analysis.

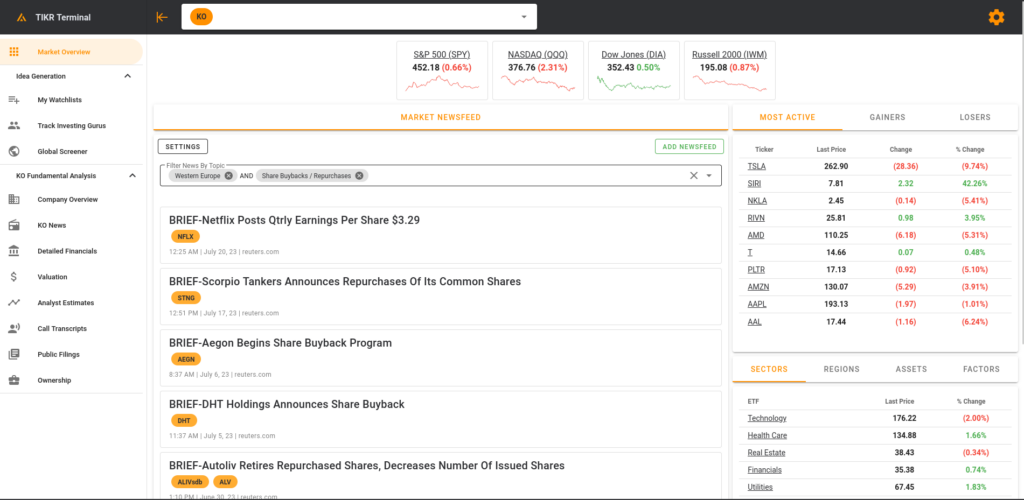

Market overview

The market overview shows the price trajectory of American indexes: S&P 500, Dow Jones, NASDAQ, and Russell 2000. Further, it has a market news feed with a built-in filter. Select news based on initial public offerings, mergers & acquisitions, product launches, shareholder meetings, and more. The screenshot above filters the news feed on a region, Western Europe, and share buybacks/repurchases.

On the right sight of the screen is a table with gainers and losers of the day visible. Also, prices of sectors, regions, and assets are available.

Idea generation

The idea generation includes a watchlist, investing gurus, and a global stock screener. The watchlist is a list compiled by you to keep track of various stocks. It has the option to add columns of your choice.

In the section “Tracking Investing Guru” are hedge funds and other funds shown. Select your favorite fund to see their holdings/investments and generate ideas for your portfolio.

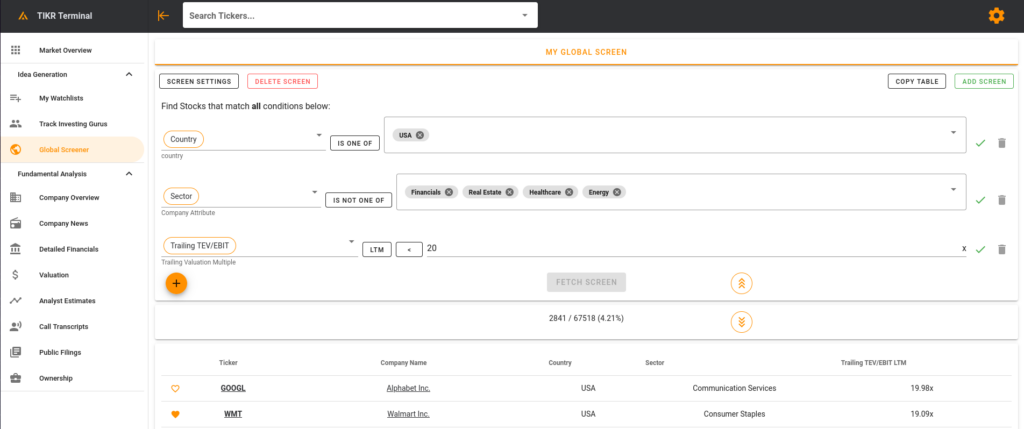

The global stock screener includes more than 100.000 companies for analysis. The screener has a built-in filter for you to find companies based on key metrics. You will quickly discover undervalued, growth, or dividend companies within your circle of competence. The filter is extensive and has selections for countries, industries, sectors, and forward & trailing metrics. Every filter condition has options to include, exclude, select time frames, and many more.

Fundamental analysis

Fundamental analysis has multiple features:

Company overview: here you have the price chart, a summary of key metrics (i.e. P/E ratio), and financial performance. A description of the company and its core business is also displayed here. Further, you will find a list of future and past events of the company.

Company news: the news tab shows the most recent company news and significant company developments, with Reuters as the news source.

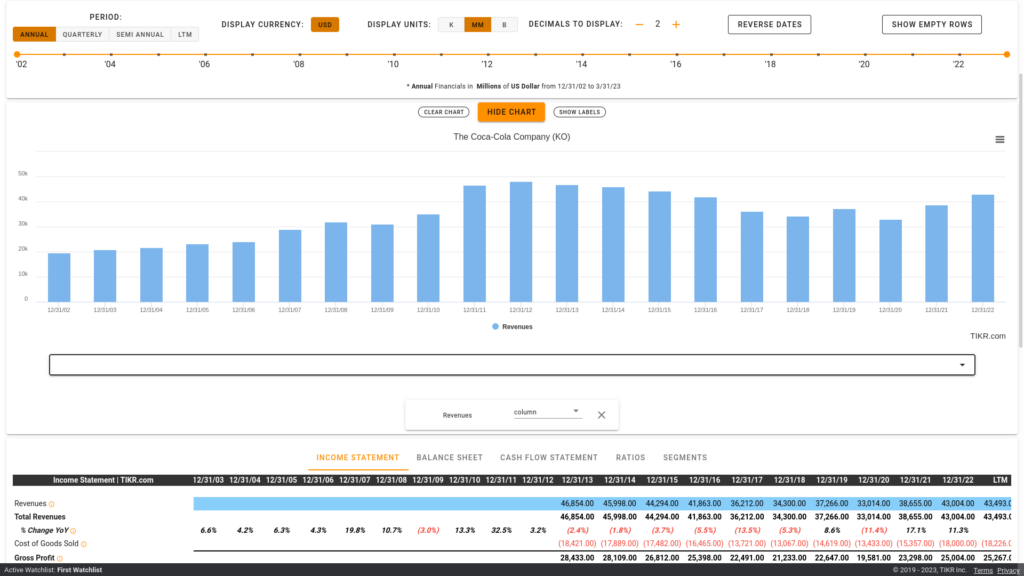

Detailed Financials include the balance sheet, income, and cash flow statements. The terminal calculates ratios like return on assets and quick ratio automatically. The financial data is shown based on personal preference. TIKR enabled selecting periods (i.e., quarterly, semi-annual, etc.), currency, units (i.e., thousands, millions, etc.), decimals, and reverse dates. The paid plans have up to 10 years of financial data available.

Valuation: this tab gives insight into forward and trailing multiples such as price/earnings ratio, FCFF, and tangible book value per share. Further, it provides street targets and comparisons with competitors.

Analyst estimates: it shows actual projections of the company and the forward estimates for metrics like revenue, cash flow, and earnings per share. The pro-paid plan includes two years of forecasts by analysts. Analyst estimates include management guidance too.

Call transcripts: read everything said during earning reports and other events. Reading back on what management has to say and questions from analysts give unique insights to understand a company, which is ideal for growing your circle of competence.

Public filings: find all the filings to dive deeper into the company. And you can download every document in PDF format.

Ownership: find out who are the shareholders of the company; use the filter to select various types of investors; and see every insider transaction under this tab.

Other key features

TIKR terminal has more features to offer on their platform:

Business owner mode: this feature gives you the power to analyze companies without displaying the stock prices. It gives you the unique possibility to examine without bias based on the stock price. This mode includes what Warren Buffett often provides as advice. It is only available in the affordable paid plans.

Language: the platform is available in English, Japanese, Chinese, Korean, Spanish, and more.

Chart: the stock chart has 20 years of price history available. It has the opportunity to compare companies pricing throughout the years. It is also possible to put critical metrics in charts for comparison.

Pricing options

At the moment, TIKR offers three plans. Plus and Pro are the two affordable plans. The third is the free plan with minimal usage to get to know the platform.

The features TIKR has to offer are fantastic for value investors. For most of you, the $ 20,000+/year Bloomberg Terminal is out of reach. TIKR is the next best alternative, with the Plus plan for $19.95/month and the Pro plan for $39.95/month (pricings may change over time).

Free plan

The stock screener has limited data and features. For example, the geographic coverage limits to the United States, and its financial history (i.e., financial statements) is up to 5 years. Also, transcripts from earnings calls are only from the last 90 days, barely enough to cover the previous quarter.

Further, you can see the holdings of the top 40 performing funds, including Berkshire Hathaway. You are allowed to save one screener and save up an unlimited amount of watchlists.

Plus plan

It has global coverage, which means that you have access to more than 100,000 stocks from all over the world! Financial & charting history is up to 10 years; read transcripts back to 3 years.

In the Plus plan, you can access detailed metrics forecasts, including gross margin, FCF, net debt, CapEx, return on equity, and return on assets. The plan also gives access to +100,000 fund portfolios. You will find great investments in addition to saving up to 5 screeners.

A great addition to this plan is the business owner mode. It hides stock prices on TIKR, and you can analyze your favorite company without bias. Last but not least, support is ready to answer all your questions anytime.

Pro plan

This plan includes, of course, the features of the Plus plan. The financial history is still ten years. However, The charting history increased to 20 years. It means you can see the figures of the statements in the table only ten years back. But you can visualize the metrics in a chart up to 20 years back, as shown below.

With this plan, you have access to the entire history of the transcripts. Extra features are access to premium data, like the management guidance and premium metrics (i.e., FCFE and FCFF) for filtering stocks in the screener. Further, you have priority support and can save up an unlimited amount of stock screeners and custom news feeds.

Who is TIKR for?

TIKR is ideal for the dividend and value investor. These types of investing require fundamental analysis for investment decisions. This platform is not suitable for day traders and pure technical analysts. The stock charts have only basic features to accommodate investors.

What features are missing?

The platform works great, but there are always slight improvements to make. An alert system is a must, preferably through the platform and email. Imagine researching various companies, and you like to buy them for a lower price. Over time, the list becomes longer. And every week you have to check the prices manually. But first, you must switch off business owner mode and later switch it on again. The automated alert system takes this tedious task away.

Another addition would be writing notes on the companies you are researching. Write a small story about why you like the company and what to pay attention to for the subsequent quarterly earnings.

Final thought

TIKR terminal has a variety of features for investors who prefer fundamental analysis for their investment decisions. All the public information of over 100.000 companies worldwide is available on a single platform. Previously, everyday investors had to consult multiple sources. Now, it is a thing of the past with TIKR.

The platform has many features to accommodate the needs of its user base. It includes financial statements of the last ten years, forward estimates, stock ownership, insider transactions, call scripts, and many more. Every company is easy to find with the TIKR stock screener.

Another high-valued feature for value investors is the business owner mode. The actual stock price of the company does not show during your research. It allows the investor to make unbiased investment decisions.

It is good to note that the platform is not a brokerage. You must leave the platform and go to your brokerage to open and close positions.

Overall, TIKR is an excellent platform for retail investors and provides all the necessary information for successful investment decisions. The platform is not suitable for day traders and other active investors.

Frequently Asked Questions (FAQ)